Investment vs. Speculation

"If he's in, I'm in."

- Dumb Money (2023)

I recently watched Dumb Money (available for streaming on Netflix). Maybe my standards were lower because I was on an airplane at the time, but I thought the movie was pretty good, especially how it captured the psychology behind recent "meme stock" frenzies. People buy meme stocks only because they see other people doing it, and seemingly getting rich in the process.

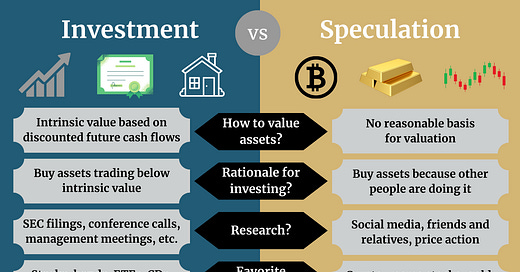

I draw a line between investment and speculation. Investors put their money into productive assets—businesses, loans, real estate, etc.—because they generate cash flows (or are expected to in the future). The discounted present value of those cash flows gives an asset "intrinsic value." You may not be able to calculate intrinsic value precisely (because the cash flows are uncertain), but with research and analysis, you can at least ballpark it.

By contrast, speculative assets don't generate cash flows, or if they do, cash flows aren't what traders are thinking about when they click "buy" or "sell." Without cash flows, there's no reasonable basis for valuing these assets. They have no intrinsic value.

Bitcoin and gold are prime examples. Speculators have nothing to base their buy/sell decisions on besides hunches about what other people might be willing to pay for them in the future. The investment case usually boils down to "Bitcoin is up 1,000% in the last five years!" or "so-and-so thinks gold is going to $3,000/ounce!"

This doesn't mean I'm bearish on bitcoin, gold, or any other speculative asset. It only means there's no basis for having an opinion. These assets could double or fall by half. I wouldn't be able to tell you why, even after the fact.

The biggest problem with speculation is this: What do you do when the price goes down, and people around you start selling instead of buying? With investment assets, you can point to cash flow as the source of intrinsic value. Take a high-quality, growing business trading for 20x normalized free cash flow. If the stock falls 50%, and there's been no change to its long-term cash flow outlook, it would be trading for 10x free cash flow. Even if the valuation multiple stays depressed, the company has options: It could pay a 10% dividend, or buy back 10% of its shares each year, or be acquired by someone who values the cash flow more highly.

If bitcoin or gold fall by 50%, what do you do? Are the assets "cheap" now? Why?

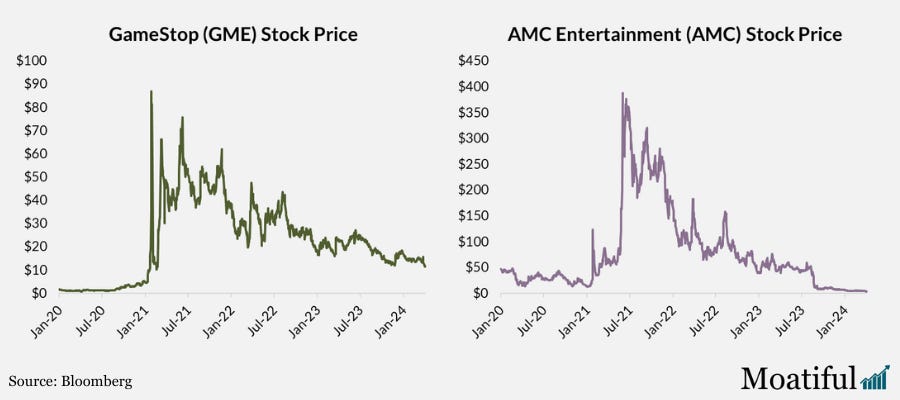

As for meme stocks, we already have ample evidence of what awaits investors left holding the bag. If the stock price is entirely determined by the level of investor enthusiasm, and the excitement (inevitably) fades, you're left with the fundamentals. Check out the stock charts for GameStop and AMC Entertainment, two prominent meme stocks:

Financial advisors can only really help with investment questions. Asking for advice about speculative assets is like asking for their take on tomorrow's lottery numbers, or tips for playing roulette. You can have fun at a casino, but I wouldn't bet my retirement on "red."

Disclosures

Moatiful is an independent publication of Trajan Wealth, L.L.C., an SEC registered investment advisor. The views expressed are solely those of the author, and may not reflect the views of Trajan Wealth. Nothing in this blog is intended as investment advice, nor is it an offer to buy or sell any security. Posts are for entertainment purposes only and should not be relied on when making investment decisions. Please consult your financial advisor for questions about your personal financial situation. All investments involve risk, including the potential for loss. Historical results may not be indicative of future performance. Data from third-party sources is not guaranteed to be accurate, timely, or complete. Links to external sources are provided for convenience only, and do not constitute an endorsement by Trajan Wealth. Clients and employees of Trajan Wealth may have a position in any of the securities mentioned. Data and opinions are subject to change at any time without notice.