Does Tesla Have a Moat?

"If somebody doesn't believe Tesla is going to solve autonomy, I think they should not be an investor in the company."

- Elon Musk

I don't know of any stock that inspires more passion—from both fans and detractors—than Tesla. Fans think the company will stop climate change, be a leader in artificial intelligence and robotics, and revolutionize personal transport with self-driving robotaxis. Detractors think the company is a fraud run by a charlatan, destined to collapse at any moment.

I've never had a stake in Tesla, except as an interested observer, but I suspect the company's long-term fate will come down to one question: Does Tesla have a moat?

Tesla's Last 10 Years

Tesla isn't distinguished for the size of its business so much as its market cap, growth, high-profile CEO, and the level of hype and attention surrounding its stock. The company delivered 1.8 million vehicles last year—96% of them from its Model 3/Y family—which was good for about 2% global market share. I count at least seven auto manufacturers with more than double Tesla's sales volume: Toyota, Volkswagen, Stellantis, General Motors, Ford, Hyundai, and Honda. Tesla isn't even the largest manufacturer of electric vehicles (EVs), since that title was recently claimed by China's BYD.

Automobile manufacturing is one of the most competitive industries on the planet. There are dozens of carmakers hungry to copy your designs, undercut you on price, erode your margins, and steal your market share. The business is capital intensive, which can sometimes be a good thing (if it creates barriers to entry) but in this case is very bad (because there are so many competitors desperate to utilize manufacturing capacity and leverage fixed costs).

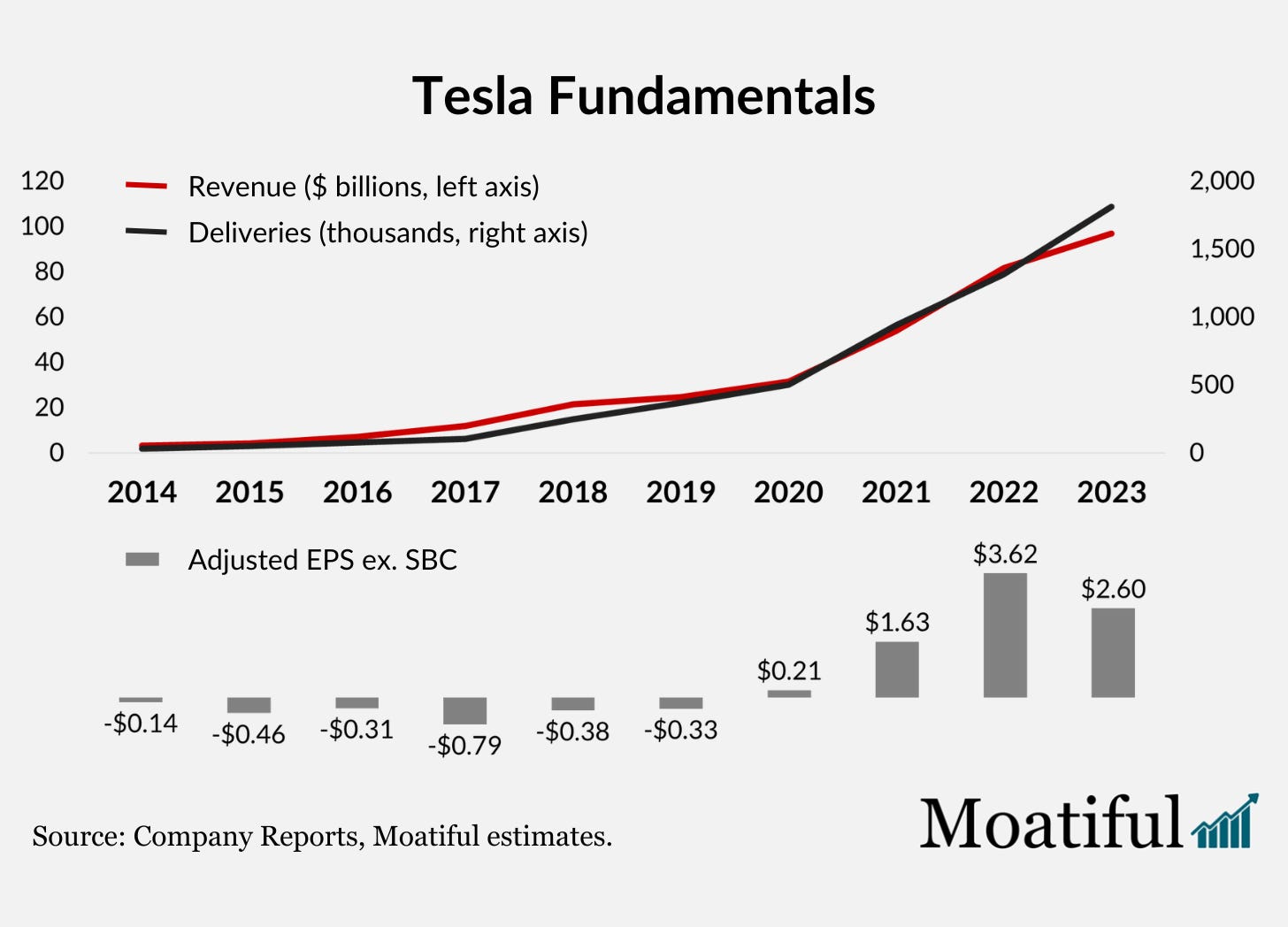

The challenging industry backdrop makes Tesla's accomplishments that much more impressive. Vehicle deliveries are up 80-fold in the past 10 years, for a compound annual growth rate of 55%. Revenue is up 48-fold; less than deliveries because of the mix shift to lower-priced models, but still enough for a 47% CAGR. And the company went from losing money to significant profitability. Deducting stock-based compensation and a nonrecurring tax item, Tesla earned $2.60 per share in 2023. Its gross margin of 18.2% was ahead of much larger automakers like Toyota and GM.

The next few quarters will likely prove more challenging for Tesla. The company's first-quarter report featured a 9% revenue decline (-13% for automotive revenue) and a 53% drop in EPS. The electric vehicle market has gotten more competitive, especially in China, and Tesla has been cutting prices to stay relevant. It doesn't help that the Model 3 was launched in 2017 and the Model Y in 2020. With millions now on the road, the cars may be losing their brand cachet, and other automakers have copied distinctive features like the large front touchscreen and panoramic sunroof. The Cybertruck is off to a slow start, with fewer than 4,000 deliveries in its first four months. Some consumers may be reconsidering the tradeoffs involved with a pure EV, opting for hybrids instead.

Investors see Tesla as more than just a car manufacturer, and management actively reinforces this investment thesis. Between economic sensitivity, capital intensity, and competition, most legacy automaker stocks trade for a single-digit multiple of earnings, with a few industry leaders in the 10-12x range. Yet Tesla, even with its stock down 59% from the 2021 high, is trading for around 65 times last year's adjusted EPS (as of 4/26/24). With earnings expected to decline this year, the P/E will likely be even higher.

Does Tesla Have a Moat?

That brings me back to my original question: Does Tesla have a sustainable competitive advantage that will let it escape the difficult economics of its industry? Here are some possible sources of a moat:

Brand. Consumers can be loyal to their favorite car brand, which might make them willing to pay a modest premium.

Vertical Integration. Tesla is changing many aspects of the car business beyond the powertrain. Most notably, the company avoided working with third-party dealerships, preferring to keep sales and service in-house. It can be difficult for legacy carmakers to imitate this model because of their relationships with dealers.

Manufacturing. Tesla's factories use more automation and robotics, and less human labor, than most competitors. Larger metal castings simplify manufacturing by reducing the number of parts. The company may have a scale advantage in producing EV-specific components like batteries.

Charging Network. The biggest drawback of EVs is the relative lack of charging stations, and how long it takes to charge, which Tesla addressed with its Supercharger network.

All of the above results in a better customer experience and lower costs, which explains why Tesla can sell electric vehicles profitably while most legacy automakers are losing billions of dollars on their EV initiatives. However, I'm not convinced it adds up to a sustainable competitive advantage. Selling millions of cars makes a brand less special, and Tesla must compete with dozens of luxury auto brands. Is the brand that much better than BMW, whose stock sells for 6x earnings? Vertical integration is a differentiator, but other manufacturers and dealers are working to make the sales and service experience smoother, leveraging online tools. I doubt many car buyers choose a vehicle based on this. Manufacturing techniques can be copied, and the growing abundance of low-cost EVs coming out of China belies Tesla's case for a manufacturing cost advantage. Lastly, Tesla has opened the Supercharger network to non-Tesla EVs. This might have been the right strategic decision—accelerating the industry’s transition to EVs—but it also removes the charging network as a competitive differentiator.

Tesla's Self-Driving Bet

That leaves one more potential moat source: Artificial Intelligence. I think Musk's quote at the top of this post, which came from the Q1 earnings call, is exactly right. Owning Tesla at the current valuation is a bet the company will figure out self-driving, and do it in a way that competitors can't match. On that same call, Musk claimed that driving a non-autonomous, gasoline-burning car will soon be like "riding a horse and using a flip phone."

Tesla's approach to self-driving is unique in two important ways. First, the company is attempting to make cars autonomous using only cameras and AI. Substantially all of its self-driving competitors are relying on a collection of cameras, lidar, radar, and ultrasonic sensors. These sensors greatly enhance the car's understanding of its surroundings, but they add significant upfront costs. Second, Tesla is "testing in production" by broadly releasing its Full Self Driving software, and regularly updating it with over-the-air patches. Competitors like Waymo have taken a more cautious approach, with extensive testing in simulation, then controlled environments with professional drivers, before gradually expanding to new geographies, different weather and road condition, and eventually opening its driverless ridehailing service to the public.

If it works, Tesla's approach will be far more effective and scalable. The company could potentially have a fleet of millions of autonomous vehicles ready to be turned on with a software update. Tesla is gathering huge amounts of real-world driving data that can be used to refine its algorithms. And there won't even be incremental hardware costs.

But that was a very big "if." Musk would tell you that humans can drive with only their eyes and their brains, so cameras and computer chips should be enough. Almost anyone else working in this field would say self-driving is a ridiculously hard problem even with precise distance and speed measurements from multiple kinds of sensors. Trying to get a car to drive itself without these tools is foolhardy, if not criminally negligent.

It's impossible to get meaningful data on the safety of Tesla's self-driving software. The company's Impact Report 2022 made the following claims about the number of accidents per million miles driven:

• With "Autopilot" engaged (mostly on highways): 0.18

• With "Full Self Driving" engaged (mostly non-highways): 0.31

• All Tesla vehicles without active safety technology engaged: 0.68

• Total U.S. vehicle fleet: 1.53.

This looks great on the surface—Tesla's self-driving technology reduces the accident rate by 80%!—but there are a few problems with the data. Tesla only counts a crash if an airbag or other safety restraint deployed. The benchmark data uses a broader definition of a crash, which helps explain why Tesla's reported accident rate is so low even without active safety technology engaged. The comparison is also distorted by when and where self-driving is used. Accidents per mile are lower on the highway than on city streets, and drivers are less likely to use self-driving in more challenging conditions like rain or navigating a construction site. Lastly, the data doesn't account for accidents that were avoided by humans disengaging self-driving when they sensed it was about to make a mistake.

Even if Tesla's software were proven to be safer than the average human driver, there remains a question of "how safe is safe enough?" Reducing the accident rate is a noble cause; more than 40,000 people were killed in motor vehicle accidents in the U.S. last year. You could argue that any technology that lowers the accident rate, even marginally, should be adopted. However, in the real world, people (and regulators) have a much lower tolerance for accidents caused by robots than accidents caused by humans. A single accident shut down Uber's self-driving program and nearly did the same to Cruise. A Washington Post story last year identified 736 crashes and 17 fatalities involving Tesla's Autopilot. It's hard to picture the self-driving program of any other automaker surviving publicity like that.

Tesla's management encourages shareholders to try Full Self Driving themselves to judge the progress. The problem is that self-driving might work great 95% of the time, but fixing that last 5% is exponentially harder. There are too many edge cases—scenarios no self-driving car has encountered before, that must be safely navigated with split-second decisions. In the absence of better comparative safety data, we're forced to rely on anecdotes. There are many videos online of Tesla's Full Self Driving making serious, life-threatening mistakes, even in relatively benign circumstances. It doesn't feel to me like the technology was ready for broad release, let alone a fully driverless robotaxi service. Management has no credibility on this topic, having spent the past decade making predictions about self-driving that didn't pan out. Even the name "Full Self Driving" implies a dangerous level of hubris.

Bottom Line

I'm skeptical about Tesla's self-driving efforts. I don't think a Tesla robotaxi service will succeed any time soon, and I'm not convinced that a cameras-only approach will ever be safe enough for broad adoption. At the same time, I'm cognizant that this is the kind of prediction that could end up looking very foolish. I sincerely hope that I'm wrong; there are thousands of lives at stake.

Without a competitive advantage from self-driving, it's hard to see a favorable risk/reward for Tesla's stock. The other moat sources are too tenuous to prevent the onslaught of competition, and it seems unlikely that Tesla will return to its former growth trajectory. If Tesla is "just another automaker," it can’t justify its huge valuation premium.

Disclosures

Moatiful is an independent publication of Trajan Wealth, L.L.C., an SEC registered investment advisor. The views expressed are solely those of the author, and may not reflect the views of Trajan Wealth. Nothing in this blog is intended as investment advice, nor is it an offer to buy or sell any security. Posts are for entertainment purposes only and should not be relied on when making investment decisions. Please consult your financial advisor for questions about your personal financial situation. All investments involve risk, including the potential for loss. Historical results may not be indicative of future performance. Data from third-party sources is not guaranteed to be accurate, timely, or complete. Links to external sources are provided for convenience only, and do not constitute an endorsement by Trajan Wealth. Clients and employees of Trajan Wealth may have a position in any of the securities mentioned. Data and opinions are subject to change at any time without notice.