Airbnb Expands the Travel Market

"For everyone who stays in Airbnb, somewhere around eight or nine people stay in hotels. And when you ask people, 'why are you staying in a hotel?'—I mean, Airbnb is typically more affordable, it's a more local experience, it's much better for groups and families—people say yes, but hotels are historically a more consistent experience. And so if we can just get one of those travelers from hotels to stay in Airbnb, that would double the size of our business."

- Brian Chesky

In Every Investing Decision Is Relative, I described the five criteria I use when analyzing stocks: Moat, Growth, Management, Financial Strength, and Valuation. Here's how Airbnb stacks up:

Moat

Airbnb's competitive advantage derives from network effects, brand, trust, and differentiated supply.

Network Effects: Most importantly, Airbnb benefits from network effects. I find this to be the most powerful source of a moat, because it's self-reinforcing. Travelers want a wide variety of accommodations. Hosts want to be on platforms with the most travelers. Any new entrant will struggle to attract one side without the other.

Brand: Like Google, Ziploc, or Clorox, Airbnb is one of the lucky few companies where its brand has become synonymous with its product. People ask, "are you staying in a hotel or an Airbnb?" It would be too awkward to say, "are you staying in a hotel or an alternative accommodation?" Thanks to its brand, 90% of customer traffic to Airbnb's website and app comes directly or via unpaid channels, which greatly reduces marketing costs. In 2023, Airbnb spent just 17.8% of revenue on sales and marketing, compared with 44.5% at Booking and 53.5% at Expedia.

(Note: This isn't an apples-to-apples comparison because of different accounting policies. For example, Booking includes payment acceptance costs with "sales and other expenses" while Airbnb puts this in "cost of revenue." If we combined these two expense categories, Airbnb would still come out ahead, but the gap would be narrower relative to Booking.)

Trust: A big part of Airbnb's brand promise is trust. Hosts trust that guests won't destroy their houses. Guests trust that they'll be safe staying in a stranger's home. Airbnb reinforces this trust with a two-way review system and insurance if something goes wrong. Once a host or guest builds a reputation through favorable reviews, it becomes a mild switching cost.

Differentiated Supply: Airbnb is especially strong with individual, non-professional hosts. Think of someone renting their city apartment while they're away on vacation for a week or renting a spare bedroom when there's a conference in town. These properties are often exclusive to Airbnb, since the hosts lack the sophistication or motivation to post their listings on multiple sites. Airbnb's average daily rate of around $160-$170 is comparable to a mid-range hotel, but the accommodations are not: A hotel room with two beds and a bathroom is very different from an entire apartment or house (including a kitchen, living room/dining room, perhaps multiple bedrooms, outdoor space, etc).

Growth

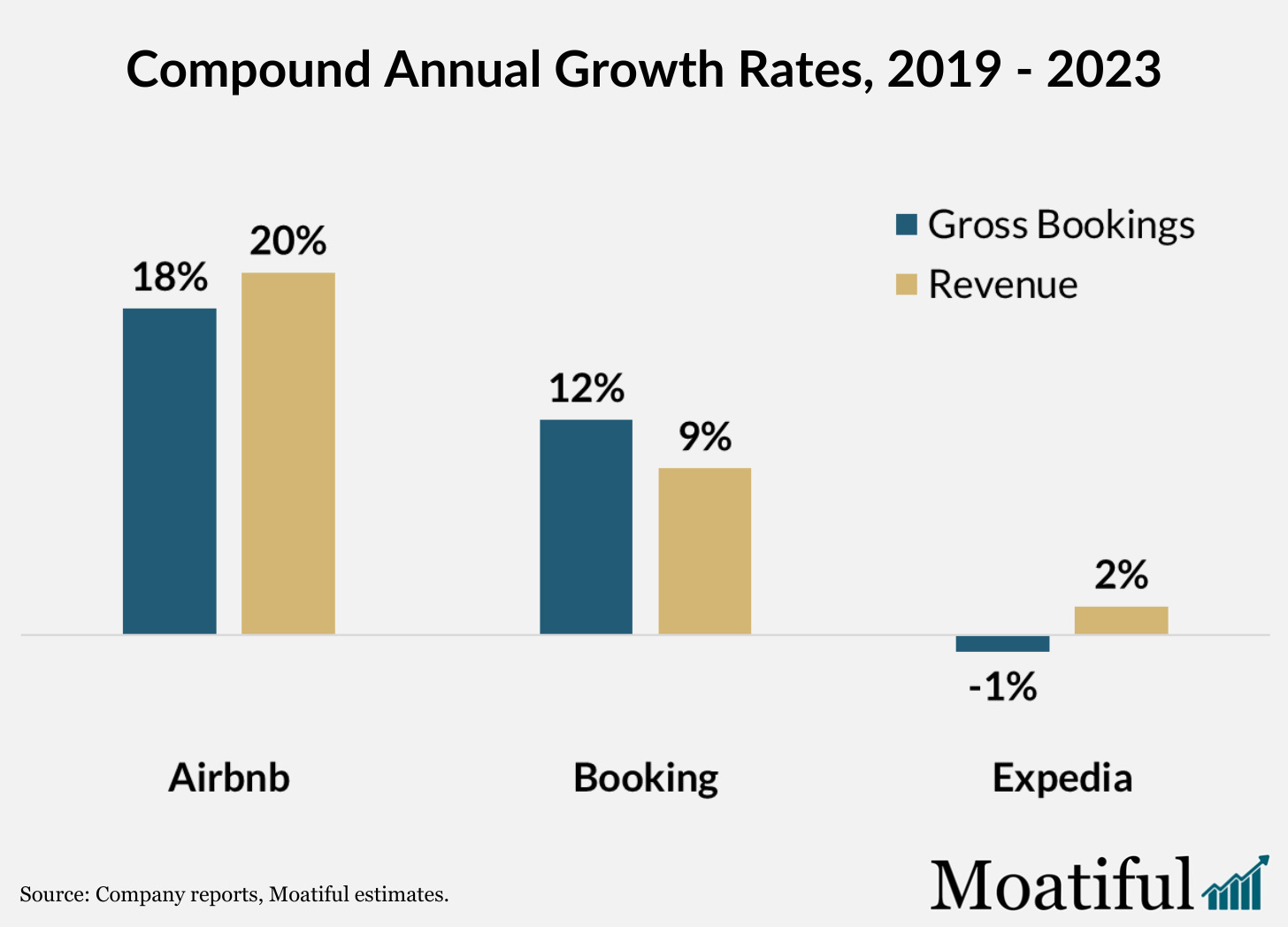

The coronavirus pandemic was disruptive to the travel industry, but Airbnb held up better than most. Customers took advantage of work-from-home policies to try living in a new place. Airbnb's revenue was down about 30% in 2020, compared with declines of 55%-57% at Booking and Expedia. Over the past four years, starting from pre-pandemic 2019, Airbnb has grown revenue about 20% per year—significantly faster than the legacy online travel agencies.

The improvement in profitability was even more dramatic. Airbnb posted an operating loss of about $500 million in 2019; by 2023, it had an operating profit of nearly $2.5 billion (excluding a one-time charge related to lodging taxes). The company slashed costs during the pandemic and enjoyed operating leverage thereafter. As long as management stays disciplined, I expect Airbnb can continue to grow revenue faster than expenses over the long term.

Airbnb is still only about 70% as large as Expedia and less than half the size of Booking, measured by gross bookings. Much like Uber expanded the taxi market or the iPhone expanded the smartphone market, I suspect Airbnb will expand the accommodation market beyond the traditional hotel business. My family and friends have taken many trips on Airbnb—staying at a cabin in the mountains or a cottage by the beach—that simply wouldn't have happened if hotels were the only option. The increased prevalence of hybrid and remote work makes longer-term stays and uncommon destinations more practical. Long-term stays of 28 days or more account for a high-teens percentage of Airbnb's room nights.

Management

Airbnb is led by co-founder Brian Chesky, who—along with roommate and co-founder Joe Gebbia—hosted Airbnb's first guests on air mattresses in his San Francisco apartment. The founders famously raised early funding for Airbnb by selling novelty cereal during the 2008 election (pictured below). Their initiative and hustle were key factors in getting invited to join startup incubator Y Combinator.

Chesky is a designer by training, and design has always been an important part of Airbnb's strategy. For example, the company realized early on that taking professional photographs of listings would make guests more likely to book. I've been satisfied with Chesky's management since Airbnb's 2020 IPO. The company cut costs, improved operating margins, accelerated the pace of technology development, listened to feedback from customers, and returned excess cash flow to shareholders. On the conference calls, you can tell that Chesky is genuinely passionate about Airbnb's mission, product, hosts, and travelers.

The area where I see the most criticism of Airbnb is its fees, including the service fee paid to Airbnb and cleaning fees charged by hosts. Management has partly addressed this with an option to search for accommodations by all-in pricing (excluding taxes), and by providing data to hosts to encourage them to set competitive prices. These improvements are welcome, but I think management has made a fundamental error with its pricing structure. In most cases, Airbnb charges a 3% service fee to hosts and around 14% to guests. In my view, hosts will follow the guests: If a room sits empty for a night, that night’s income is lost forever. In other words, guests are more sensitive to fees than hosts would be. Airbnb would do better to copy Booking and Expedia, which charge all their fees to the hotels (making fees invisible to guests).

Financial Strength

Airbnb's business model requires almost no physical assets. Better yet, the company collects payments from travelers more than a month before it has to pay hosts (on average), which makes the business self-financing. Airbnb can earn interest income on this "float." Excluding cash and investments, the balance sheet shows negative invested capital (shareholder's equity + long-term debt - cash & investments = -$1.2B).

As long as the company is growing, free cash flow should be above net income. Airbnb reported trailing-12-month free cash flow of $4.2 billion as of Q1 2024, or $3 billion if we exclude stock-based compensation. A company that can earn plentiful and growing free cash flow, while investing none of its own capital, is the very best kind of business.

Valuation & Risks

Airbnb reported 654 million fully diluted shares outstanding in Q1, down 2.4% year-over-year thanks to share repurchases. At Friday's closing price of $144.93, that would imply a market cap of $94.8 billion. The trailing price/free cash flow multiple is 23x (very reasonable), or 32x if we exclude stock-based compensation (a bit pricier). According to Bloomberg, consensus estimates call for earnings per share of $4.75 this year and $5.35 in 2025, implying current and forward P/E ratios of 31x and 27x, respectively. These multiples strike me as reasonable for a company expected to grow revenue double-digits annually over the next five years, especially since EPS should grow meaningfully faster than sales. On the other hand, Booking is forecast to grow revenue only a few percentage points slower than Airbnb, while its stock trades for 21x current-year earnings and 18x forward.

Two other risks to keep in mind are economic sensitivity and regulation. I already described how Airbnb's revenue was down 30% in 2020. The coronavirus pandemic was a once-in-100-years event, but it's fair to assume people will travel less during a recession. On the regulatory front, some jurisdictions are permissive of short-term rentals, while others have banned them entirely. Regulators must weigh the benefits of tourism, neighborhood economic opportunities, and personal freedom against the potential costs of limiting housing supply for local residents and disturbances like traffic congestion, noise, or safety issues. The good news is that most regulation happens at the municipal level, and Airbnb is well diversified geographically. New York City recently implemented one of the strictest short-term rental laws in the world (effectively banning most listings), but it was barely a blip for Airbnb because the city only accounted for about 1% of revenue.

Disclosures

Moatiful is an independent publication of Trajan Wealth, L.L.C., an SEC registered investment advisor. The views expressed are solely those of the author, and may not reflect the views of Trajan Wealth. Nothing in this blog is intended as investment advice, nor is it an offer to buy or sell any security. Posts are for entertainment purposes only and should not be relied on when making investment decisions. Please consult your financial advisor for questions about your personal financial situation. All investments involve risk, including the potential for loss. Historical results may not be indicative of future performance. Data from third-party sources is not guaranteed to be accurate, timely, or complete. Links to external sources are provided for convenience only, and do not constitute an endorsement by Trajan Wealth. Clients and employees of Trajan Wealth may have a position in any of the securities mentioned. Data and opinions are subject to change at any time without notice.